Mortgage Information

The following required

information is the main input for Excel Mortgage Calculator to make the

pertinent calculations and get the mortgage values:

- The Loan Amount or total amount of money being borrowed (not including any previous down payment).

- The Annual Interest Rate specifically applied to the mortgage.

- The Loan Term, which is the number of years to pay off the whole sum (generally 20 or 30, or even longer, depending on numerous factors).

- Number of Payments per Year (generally 12).

On top of those

values, an additional extra payment can be computed into the Excel Mortgage

Calculator in order to account for deductions to the loan term and, subsequently,

to the balance and cumulative interest. All those values can be either directly

input into the corresponding cells of the worksheet “Calculator”, or through an

Excel VBA UserForm that pops up when clicking “Change Values”.

The UserForm is

activated with the ‘Show’ method (see below). ‘MortgageValues’ is the name of

the UserForm (otherwise, ‘UserForm1’ is the default name when adding a new one).

Once active, the ‘Initialize’ procedure adds the current values to the form as

indicated below.

Sub OpenChangeValues()

MortgageValues.Show

End Sub

Sub UserForm_Initialize()

With MortgageValues

.LoanAmount.Text =

Format(Sheets("Calculator").Range("C4"), "€

#,##")

.InterestRate.Text =

Sheets("Calculator").Range("C5")

.LoanTerm.Text =

Sheets("Calculator").Range("C6")

.PaymentsPerYear.Text =

Sheets("Calculator").Range("C7")

.ExtraPayments.Text =

Format(Sheets("Calculator").Range("C12"), "€

#,##")

End

With

End Sub

The values can

be then updated in the form and, when saving, they will be copied to the

corresponding cells (using ‘Range’) of the worksheet “Calculator” to

automatically make calculations and update the results.

Sub UpdateValues_Click()

Sheets("Calculator").Select

With

MortgageValues

Range("C4") = .LoanAmount.Text

Range("C5") = .InterestRate.Text

Range("C6") = .LoanTerm.Text

Range("C7") =

.PaymentsPerYear.Text

Range("C12") = .ExtraPayments.Text

End

With

Unload

Me

UpdateChart

End Sub

Mortgage Payments

Excel Mortgage

Calculator makes use of some Excel formulas to calculate the scheduled payment

amount for the given loan amount, annual interest rate, payments per year, and

total number of payments. The formula used to do so in Excel is PMT, which

gives a negative value as that amount deducts from the balance. In order to get

the positive value shown in C10 we use the following expression:

=-PMT(InterestRate/PaymentsPerYear,NumberPayments,LoanAmount)

As explained

earlier, Excel Mortgage Calculator allows to account for an optional extra

monthly payment. That amount is added to the mortgage payment, and the total

payment minus interest equals the principal, which is the amount deducted from

the loan amount every period.

Note that the

names for each variable have been defined and can be found in the Excel Name Manager.

Thus, names can be used in formulas as substitutes for cells references.

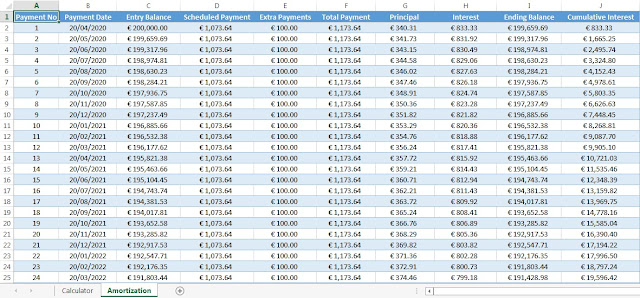

Amortization schedule

Excel Mortgage

Calculator presents monthly payment information in the amortization table along

with balance, principal and interest movements. The table updates automatically

when changing the mortgage values, and allows to calculate the total interest

and the actual number of periods when extra payments are added.

The amortization

chart shows the balance, and cumulative principal and interest for each year.

That data is looked up in the amortization table with the VBA WorksheetFunction.VLookup

method, and copied into cells behind the chart of the Excel Mortgage

Calculator. The chart is updated every time the input values change as per the

following worksheet event procedure:

Private Sub Worksheet_Change(ByVal Target As

Range)

If MortgageValues.Visible = False Then

If Not Intersect(Target,

Target.Worksheet.Range("C4:C7")) Is Nothing _

Or Target.Address = "$C$12" Then

Call UpdateChart

End If

End

If

End Sub

Click Here to download

the Excel Mortgage Calculator.

No comments:

Post a Comment